We don’t put enough effort into finding out why good people leave. Here’s why we really ought to.

By Kevin Oakes

This past January, Jim Yong Kim, president of the World Bank, unexpectedly announced his resignation a full 3.5 years before his second five-year term was set to expire.

Kim’s reappointment to that office, which began in July 2017, had been unanimously agreed upon by the members of the bank’s executive leadership. In a press release, the World Bank lauded Kim’s vision, leadership, and accomplishments, which included meeting lending demand over his first term (2012–16) at levels not seen outside a financial crisis.

Kim’s decision to quit for the private sector, a move that “sent shockwaves through the international aid community,” according to one news outlet, was described by sources close to the bank as a sudden, personal decision that surprised its shareholders—the 189 nations that support its work.

The departure left most asking a simple question: Why? You’ve probably wondered the same thing after a rising star suddenly exits your organization. When companies lose their top talent, it isn’t uncommon for speculation to run rampant: More money. Bigger role. Needed a change.

These excuses go on and on because of one primary reason: We simply don’t put enough effort into finding out why good people leave. But we really ought to try.

When It Comes to Turnover, What You Measure Matters

The most standard employee data measured in organizations (following total number of employees) is turnover rate. Research conducted by the Institute for Corporate Productivity (i4cp) reveals that most organizations track this number. But tracking turnover alone provides very little insight.

Interest in benchmarking information on employee turnover data is always in demand (particularly by senior leadership), as is worry about the increasing demand for skilled workers and the limited supply.

But are companies able to get out in front of turnover by focusing efforts on benchmarking themselves against other organizations? Our research suggests the answer is no. They must first look inwardly and assess who is leaving and why.

Did high-potential, high-performing employees depart because they didn’t have faith in the leadership or the direction of the company? Did they have the tools they needed to be successful? Did their managers know they were at risk of quitting?

While external benchmarking can lend some insights, comparing one company’s turnover rate to another’s doesn’t provide enough information for useful decision making. The causes of turnover, even within the same industry, are unique to the DNA of each organization. No two company cultures are identical; nor are the reasons for employee turnover.

Rather than focus on benchmarking, high-performance organizations zero in on identifying the causes of turnover and what action is needed to decrease it.

Part of this internal focus is understanding the quality of the attrition. Is the turnover happening among people in critical roles with skills that are difficult to replace, or is it concentrated in areas where the skills are easily duplicated and in roles that aren’t critical to business success?

This analysis starts to build a clearer picture of whether or not the turnover benchmark in your company is concerning.

Want Less Turnover? Be More Proactive

To decrease unwanted turnover, high-performing companies proactively investigate why their critical talent leaves and why it stays. The answers to these questions may vary by role, location, or a combination of many other factors, but are important to understand so you can develop strategies with impact.

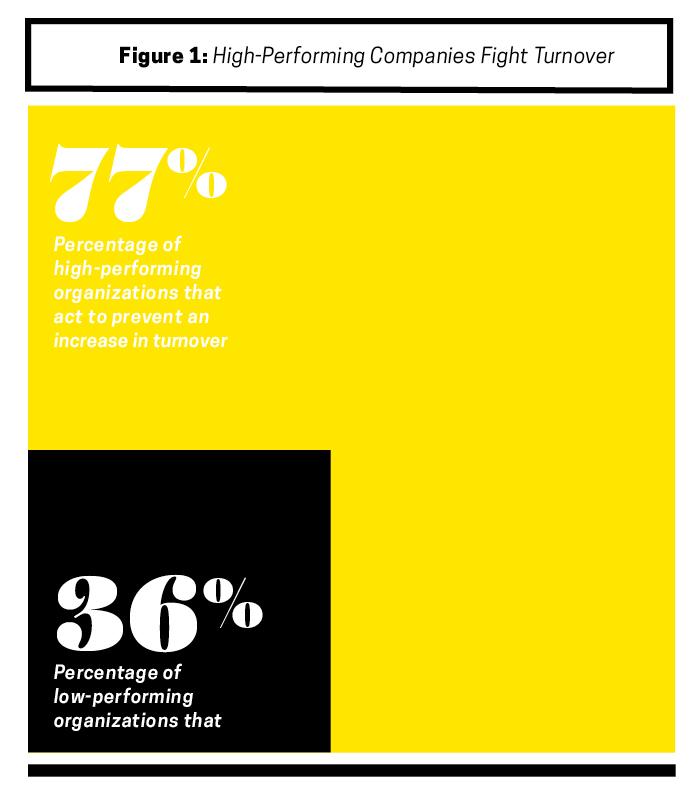

A proactive approach to turnover is much more prominent in top organizations. In fact, the i4cp research in Figure 1 shows that high-performing companies act to prevent increases in unwanted employee turnover more than twice as much as lower performers.

Determining who is leaving begins with segmenting the workforce. Some talent segments are more critical to the business than others. If a segment isn’t core to the success of the business and its function doesn’t require skills that are difficult to acquire, catering to its needs may be a waste of resources.

If the opposite is true, developing strategies to control unwanted turnover in these critical segments will result in meaningful returns for the company. After identifying the segments, the next step is understanding why talent in these segments stays and leaves.

Exit Interviews Versus Exit Surveys

Exit interviews are one of the most popular methods for understanding why people leave their employers. Over 80 percent of the respondents to i4cp’s survey on turnover reported that their organizations practice the process. But at most companies, that process is broken.

You know the scene: On his final day, the exiting employee typically sits down with an HR representative and goes over very tactical information—turn in your key card, here’s your benefits information, where’s your laptop? The “strategic” conversation about why someone is leaving is usually just one more check box. Or worse, it’s nonexistent.

A good exit interview can help reveal an employee’s reasons for leaving and dig deeper than the commonly cited and safe departure reasons like “career growth” and “better job opportunity.” It can also produce data that affirms (or rejects) common hypotheses for turnover, which can be used for benchmarking and organizational improvement.

But benefits be damned, exit interviews universally suffer from the same barriers. Participation is low due to the departing employee’s natural reluctance to burn bridges, and busy HR representatives don’t prioritize the interview’s importance. As a result, the exiting employee gives a general explanation for leaving instead of providing specifics that might help to develop strategies that address unwanted turnover.

The information gathered via exit interviews also tends to be inconsistent because the conversations are conducted by different people who have varying styles and approaches. They may ask different questions and attach a different meaning to what they hear, making it difficult to aggregate and analyze the data. Last, exit interview data is rarely aggregated and deeply analyzed.

As opposed to interviews, companies have turned to exit surveys to provide better information. Today, while many organizations will say they have exit surveys, most also admit they’ve had poor experiences. Some of the barriers to completing exit surveys are the same as interviews (not wanting to burn bridges, unbridled apathy), but a good survey process can often yield better and more useful data to stem attrition in the future.

Many organizations turn to external third parties to conduct exit surveys, which often results in more candid, detailed information. Several companies have discovered if they repeat the survey a few months after the candidate has departed, it sometimes results in bringing that person back as a boomerang employee.

Overall, gathering data in a systematic, regular process gives organizations better capabilities to analyze and benchmark that data to reduce future turnover.

The Power of Stay Interviews

It’s equally important to discuss how to prevent attrition through proactive measures. Stay interviews—conversations with high-performing incumbents about why they’re committed to staying with the organization—are as valuable as exit interviews. Conducting stay interviews with the best employees, ideally while they’re still engaged, helps managers determine what top talent values and what keeps them with the company.

All you need to do is identify current employees with the skills, attitudes, and performance levels that represent the kind of talent the company values and find out why they stay and what might prompt them to leave. Then, use stay interviews to learn about the positive aspects of the work, environment, relationships, and other factors that keep great employees happy, productive, and loyal.

Stay interviews don’t just provide valuable feedback to the company—they also demonstrate that the organization cares about the employee. Additionally, these discussions could uncover small issues that can be addressed before they fester and escalate to larger, deal-breaking issues that result in unwanted turnover of key personnel.

So what’s the catch? Even with their obvious benefits, our research shows only 22 percent of high-performing organizations currently conduct stay interviews, despite a significant correlation with market performance. This is a next practice by definition—one that can have a positive impact on the bottom line, but may not be widely practiced, at least in systematic fashion.

The Measures That Matter

There are additional measures and methods organizations can use to correctly track attrition. The more effective strategies include the following:

Quality of hire. i4cp research shows that more than three times as many high-performing organizations measure quality of hire than lower-performing organizations. Quality of hire communicates the value an organization gets for effort and money spent on recruiting, as well as how effective the business is at assimilating its new hires into the organization.

Hiring managers should be held accountable for the quality of hire. The two big factors to measure are retention over time—are new hires still with the firm after 90 days, one year, or two years?—and time-to-full productivity. Better hiring practices should bring in people who up the learning curve faster.

Compared to other common metrics such as cost per hire and time to fill (both used by low-performing organizations more so than high performers), quality of hire is generally considered the metric that best demonstrates talent acquisition’s strategic value.

Attrition and retention scorecards. Top organizations develop a scorecard to measure quality of turnover and hold managers accountable for the results. Part of this process should include ensuring that the definition of regrettable turnover (or unwanted attrition) is clearly communicated and understood.

While there are many data points that could be included in the scorecard, the following are considered the core quality metrics:

- Voluntary turnover for the entire workforce.

- Voluntary turnover by critical talent segment.

- Voluntary turnover for high-performers by critical talent segment.

- Regrettable turnover by critical talent segment.

Cost of attrition. Measuring attrition of critical talent segments should be more than just an attempt to tell a story of the number of employees no longer with the firm. The negative impact of higher-than-desired turnover rates is well known, but by calculating the cost, it can be used as a major part of the business case to focus more closely on attrition.

The problem with measuring the cost is there are many intangibles that can be included in the “real” cost of a departed employee. These factors can include both hard and soft costs like:

- All the investments associated with hiring a new employee, such as recruiting fees, marketing, time spent screening, and interviewing.

- Onboarding costs.

- Training costs for the new employee.

- The loss in productivity it takes to get a new employee ramped up to the level of the previous employee.

There are other elements in play, but what’s important is agreeing on what goes into the measure, and then being consistent in tracking the costs.

While measuring common turnover metrics can be considered table stakes, high-performing organizations focus more deeply on benchmark metrics that can be analyzed over time.

These measurements should lead to core strategies that positively affect unwanted turnover and ensure the most critical talent in the organization is retained for longer periods of time.

This will also prevent having to accept excuses like more money, bigger role, and needed a change, and instead provide actionable information that will improve the long-term health of the organization.

Time-to-full productivity is a metric that few organizations use, but which many acknowledge they should be tracking. Just 16 percent of respondents to an i4cp survey stated that they use the metric to a high or very high extent, but 64 percent say they should be using it to manage talent more effectively. There are various ways to define it:

• Time required to ensure a new employee has all the credentials and equipment needed to perform the job.

• Time required for a new employee to master the skills needed to perform the job duties at a fully productive level.

• Time required for the new employee to achieve a degree of proficiency that matches that of a colleague with two to three years of experience.

Why You Should Measure Time-to-Full Productivity

Tracking time-to-full productivity offers the benefit of yielding insights into multiple organizational functions. Here are four ways your organization can use the metric to improve programs and the effectiveness of the workforce:

- Gauge the success of the recruitment process. A candidate who was accurately sourced and screened should come up to speed in an expedient manner, while a poor hire (lacking in credentials or skill sets, for example) might be more likely to flounder.

- Align job descriptions to the reality of the workplace. Using the previous example, a slow path to proficiency might indicate to HR that it’s not providing accurate job descriptions to candidates.

- Determine training success. If a new hire has been assigned a mentor or a coach, the employee’s speed to productivity can offer one means of evaluating the effectiveness of that experience.

- Identify impediments to productivity. The time-to-full productivity metric can reveal factors that lengthen the time an employee requires to reach full competency.

Kevin Oakes is the CEO of the Institute for Corporate Productivity (i4cp), the fastest-growing and largest corporate network focused on the practices of high-performing organizations. In addition, he has been a leader in the human capital field for the past two decades, and was previously the founder and president of SumTotal Systems.